Dubai

Self-Driving

Transport Strategy

& Roadmap

Summary

Executive Summary

A Vision for the Future of Transport

International Benchmarking

Dubai Strategy

SDT Roadmap

Table of content

4 5

Executive Summary

Self-driving Transport (SDT) has long been a goal of the transportation technology

research community. As far back as the 1970s, early efforts in the US and the UK

produced limited self-driving functionalities in automobiles. What was once a distant

goal, is now becoming a reality. Self-driving Transport systems offer to transform

not only the way we understand and use transportation, but also our social life.

SDT technologies promise to transform the private vehicle industry, and even more

importantly for Dubai - the mass public transport.

Today, Dubai Metro is one of the largest self-driving public transportation systems

in the world while other public transport modes such as first-mile-last-mile shuttles,

BRT are also making considerable progress towards achieving self-driving

functionalities. His Highness Sheikh Mohamed bin Rashid Al Maktoum has

announced a goal that “by 2030, 25% of all transportation trips in Dubai will be

smart and driverless.” In view of achieving this goal, this report outlines a strategy

and roadmap for developing self-driving transport services in Dubai – focusing

primarily on the public transport.

Global studies suggest that the benefits of SDT could be huge ranging from highway

safety benefits to reduced parking costs, reduced mobility costs, environmental

benefits, improved productivity, and improved quality of life and citizen happiness.

In Dubai, it is estimated that these benefits of SDT would be valued at more than

AED 22 Billion per year.

The strategy is prepared with clear sight on the current SDT technology status,

key challenges, and the trend of technology based on the research and development

efforts and the investments made and pledged by worldwide governments and

private investors.

While there have been significant developments by car manufacturers such as Tesla,

Volvo, Mercedes Benz; technology companies such as Google; and ridesharing

companies such as Uber; considerable challenges remain unresolved in safety,

legislation and technology capability of the vehicles.

In Dubai, the challenges are further raised by the extreme weather conditions

and the diverse cultural mix of drivers and other road-users.

6 7

“Today we launched Dubai

Autonomous Transportation

Strategy, by 2030, 25% of all

trips in Dubai will be driverless”

His Highness Sheikh Mohammad Bin Rashid Al Maktoum

Vice President and Prime Minister of the UAE and Ruler of Dubai

8 9

A Vision for the Future

of Transport

As a part of Dubai’s Smart City strategy, His Highness Sheikh Mohammad bin Rashid

Al Maktoum recently announced a goal that “by 2030, 25 percent of all transportation

trips in Dubai will be smart and driverless.”

As part of the initiatives to achieve this ambitious goal, RTA retained a team

of Self-driving Transport (SDT) experts to develop an actionable roadmap and an action

plan. This Self-Driving Transport Project will provide a vision, roadmap, and policy

framework comprising a comprehensive strategy for testing, development,

and deployment of SDT.

Considering the technology readiness and the trends, we have developed

a unique SDT strategy for Dubai which would set Dubai apart in the following ways:

Multimodal SDT

While other major cities/countries are typically focusing on enabling the self-driving

private vehicles, Dubai should target SDT across all 7 modes of public transport fleet

including metro, tram, bus, taxi, marine transport, cable cars and shuttle. This means

that the industry partners will be able to develop their technology with ease

by working in partnership with the RTA. Currently, the self-driving Metro is estimated

to serve approximately ~9% of all individual trips in Dubai.

Design and deploy a self-

driving public transport

system

Infrastructure analytics for

the SD vehicles

Deploy HD mapping with

over the air update

A code of practice with a

level based approach

Conceptualize, design and

deploy a connected cloud

Policy/legislation for the

operation of SDT

Study, define and

implement robo-taxis

Worldwide Competition

Dubai will host a worldwide SDT competition. SDT practitioners from across

the globe will be invited to participate in the competition and showcase their

technology, processes, abilities and strengths in SDT.

For Dubai, this will be a great way to not only try out these technologies, learn critical

lessons, but also to become one of the leading attractions for SDT investors

and technology researchers across the globe.

SDT Operations Policies/Legislation

Dubai should lead the world in policies and legislation for SDT operations. To achieve

these unique feats, this report outlines a detailed roadmap for self-driving public

transport, connected vehicles, and private SD vehicles. Additionally, the project

has developed key building blocks/enablers and detailed initiatives to ensure

that the roadmap deployment can be achieved.

The key pieces of the roadmap and building blocks are:

10 11

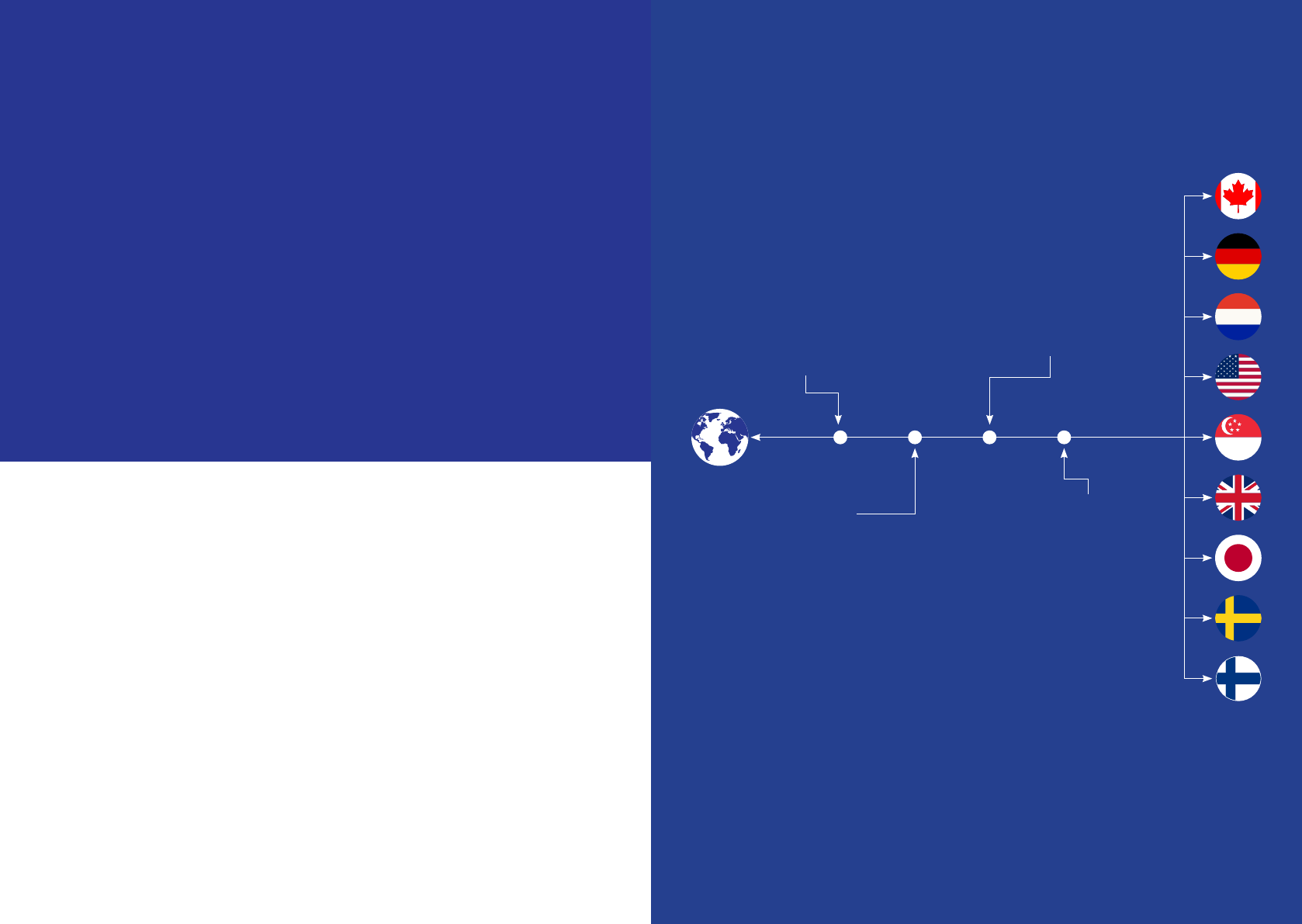

Self-Driving Transport is a worldwide phenomenon. Research and development

work on self-driving transport systems is occurring in all major developed

countries in North America, Europe, Asia and Australia. Advances in research and

development of SDT technology are being announced almost on a daily basis,

and industry perception is continually changing for even the most knowledgeable

people in the field. There are parallel research and development processes

occurring between Self-driving Transport systems and Connected Vehicle (CV)

communication technologies. CV technologies enable safer and more efficient

driving for both human and computer driven vehicles through warnings and

detailed information sharing. Hundreds of projects have been undertaken

worldwide to advance both self-driving and connected vehicle technologies.

International

Benchmarking

Following countries were

selected for detailed study

Level of SDT

Maturity

Ambition Regulation Infrastructure

Level of

Prosperity

Urban Mobility

Development

Innovation

of PT Initiatives

12 13

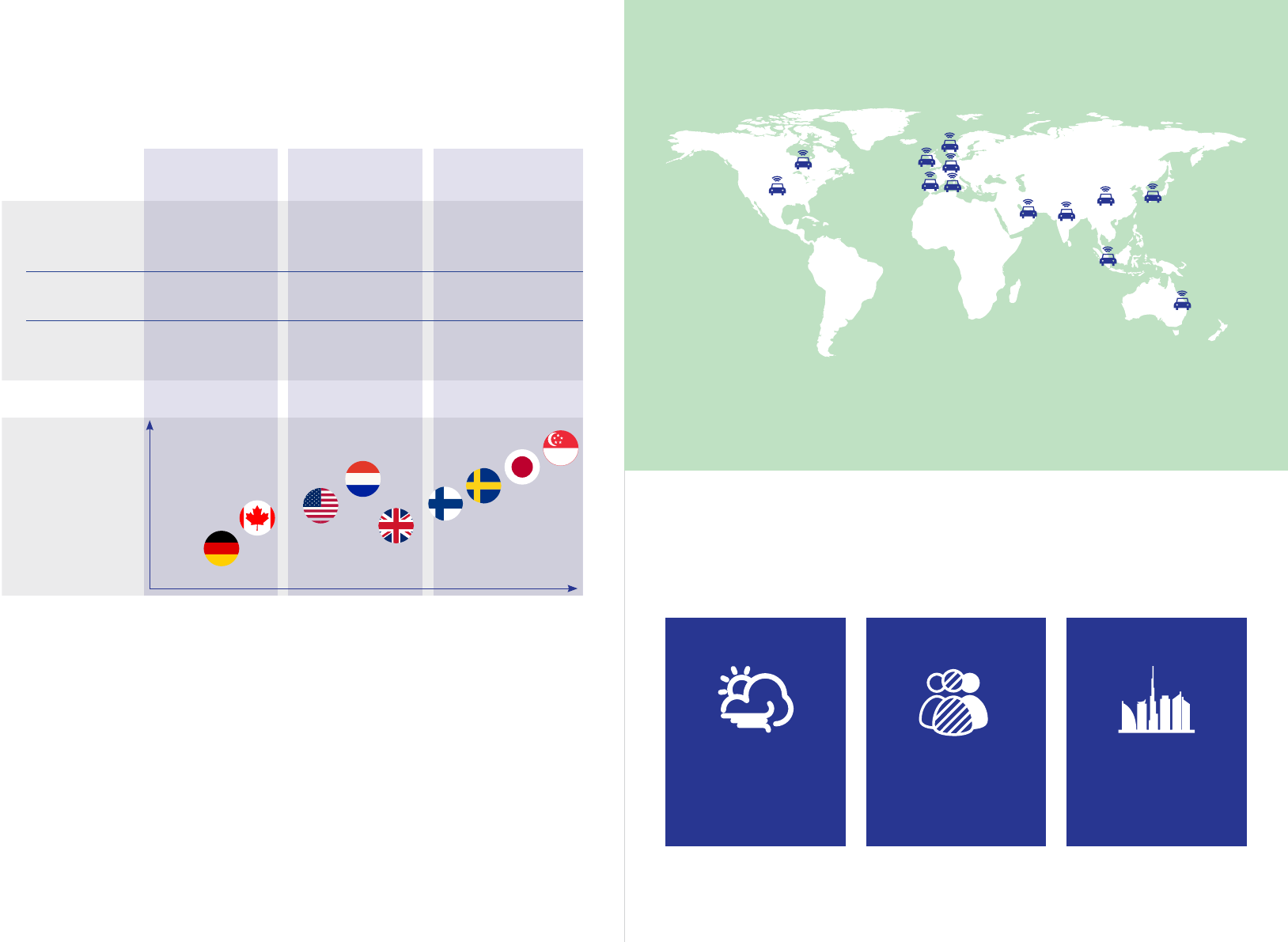

Three SDT models have been identified

from global benchmarks

High

Low

High

Transport

Modes Covered

Private Driven

Model

Funding

No clear target

Limited public

support

Selected modes

Level of Public Involvement

Government sets

targets and pvt.

consortiums aid

decision making

Equally shared by

government

Major transport

modes

Government leads

target setting and

decision making

Limited private

participation

All public and private

transport modes

Common

Characteristics

Countries Mapping

Hybrid

Model

National Program

Model

SDT Target

Mobility Focus

Additionally, Dubai offers unique challenges to the SDT with extreme weather conditions,

cultural diversity and challenges related to first mile last mile applications due to the high

temperatures in the summer.

Extreme Weather

Conditions

Humidity, Fog, Sandstorms

Cultural Diversity

People Acceptance

First Mile/Last Mile

High Temperatures

Local Challenges

Figure 1: SDT - A worldwide phenomenon

14 15

Dubai Strategy

The uniqueness of the Dubai SDT Strategy is focused on the provision of

comprehensive, multi-modal SDT services. SD public transport services have the

potential to transform mobility in Dubai as a key component of the Dubai Smart City

and Smart Life strategies.

While vehicle manufacturers are generally taking an evolutionary, driver-centric

approach to providing SD vehicles, SD public transport can evolve quickly in Dubai

using public transport and first-mile, last-mile connections.

Dubai can meet the 25% SDT trips goal faster by focusing on systems that RTA can

control and by bringing more travelers to the Metro and other public transport modes.

Dubai is also among a small number of unique governments in the world with

an integrated transport agency structure. Transport management in the U.S, Canada,

Australia, UK, and Europe includes a patch-work of local, regional, state and

federal agencies that have varying levels of responsibility and jurisdiction. While the

collective resources of regions such as the U.S and Europe may be larger than Dubai

and the UAE, the distributed nature of funding, regulatory authority and inter-regional

politics makes the path to progress less smooth.

In particular, the management of public transport services and traffic services is

generally separated in most other first-world transport agencies, and will slow

progress in public transport service provisions. With the inspirational support

provided by Dubai leadership, the pace of development and deployment in

Dubai will be accelerated with respect to other first-world regions with targeted

investment, smart partnerships, and unwavering dedication to implementing the

activities on the roadmap and the building blocks.

Overall, three (3) areas have been identified for Dubai to be the leader in the world

for SDT.

Multimodal SDT

Unique

SDT

16 17

Multimodal SDT

Worldwide SDT Competition

As described in the previous sections, a lot of major cities have allowed

SDT testing in their respective jurisdictions. However, these places

have been focusing primarily on automation of private vehicles

and freight movements through automation of heavy vehicles (trucks).

In contrast, Dubai should target Self-driving Transport across

all 7 modes of public transport. This will enable a harmony of SD

systems across transport modes and will accelerate the conversion

of traditional trips to SDT trips.

As part of the SDT target announcement by His Highness Sheikh

Mohammad Bin Rashid Al Maktoum, he envisioned Dubai to host

a worldwide SDT competition which will be unlike any other such

competition. The details of this competition will be announced

very soon, but it is important to note that this will be an opportunity

for all manufacturers, operators, researchers and academics to

showcase their strengths and capabilities, to further propel SDT

in this region and throughout the world. This competition

will be a key part of Dubai’s strategy.

SDT Operations Policies/Legislation

While there are many trials/demonstrations of self-driving vehicles underway

throughout the world, there exists a clear and significant gap in policies

and legislation related to the revenue based operation of self-driving vehicles.

Dubai should lead the world in developing these policies and legislation to allow

full operation of self-driving vehicles on the public streets of Dubai.

The initiatives listed above include capital intensive projects such as public

transport, robo-taxis and infrastructure projects. However, there are opportunities

to partner with the private entities to offset some capital cost and mitigate some

risks of operation and maintenance of new assets. Further, these partnerships

will ensure that Dubai stays at the frontier of new technologies without always

having to renew investments.

The efforts required to undertake the proposed initiatives and building blocks

span across the RTA agencies. The agencies will need to invest significant effort

in study, design and development of the initiatives in coordination with internal

and external stakeholders. Equally, the execution of the roadmap activities

will require a champion to oversee the entire initiative, review progress made

by each agency and external stakeholders, and strategize how to stay on course

to achieve the 25% target. In addition, the report proposes that the feasibility

of a RTA Center of Excellence (CoE) be studied further. The CoE would lead the

research and development of new technologies and would create an ecosystem

to drive technological concepts to their deployment stage.

Based on the technology readiness, SDT strategy and roadmap and the building

blocks initiatives, it is estimated that public transport, robo-taxis, first-mile

last-mile and private cars will account for majority of the 25% of self-driving trips

in Dubai by 2030. Incentives and other enablers for SD private vehicles will likely

drive the percent of SDT to more than 25% by 2030.

As shown below, different transportation modes will contribute to SDT adoption

and the percentage of SDT individual trips will build on over the years as the public

transport modes design, test and deploy SDT systems in Dubai.

18 19

• Testing

• Operations

• Driver behavior in Level ٢-٣ vehicles

• Driver acceptance of SDT

• SDT driver licensing

• SD vehicle testing, registration, renewal

• Crash liability of self-driving vehicles

• Insurance requirements

• Infrastructure improvements for SDT

• Crowd sourcing and analytics

• Self-driving vehicle security

• On-board data recording and retrieval

• Communication (V٢I, V٢V, V٢X)

• Connected cloud

• Accurate HD mapping

• Over the air update

٢٠١٦

٢٠١٧

٢٠١٨

٢٠١٩

٢٠٢٠

٢٠٢١

٢٠٢٢

٢٠٢٣

٢٠٢٤

٢٠٢٥

٢٠٢٦

٢٠٢٧

٢٠٢٨

٢٠٢٩

٢٠٣٠

Dubai SDT

Enablers

١. Legislation

٢. Driver Behavior & Acceptance

٣. Driver & Vehicle Licensing/Registration

٤. Insurance/Liability

٥. Infrastructure Requirements

٦. Cyber Security/Data Privacy

٧. Connected Vehicle Enablers

٨. HD Mapping

٪٢٥

It is projected that the SDT modal share

will grow from the current expected level

of approximately 9% to reach 25% in 2030

SDT Modal Share %

2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030

9.4%

25.0%

20 21

SDT Implementation Plan

to Achieve 25% SDT by 2030

Transport

Mode

2020 21 22 23 24 2025 26 27 28 29 2030+

Bus

Taxi

L3 Buses (limited number) L4 Buses

L4 Community Taxi L4 Everywhere Taxi

Trials and small scale roll-out L4 Dynamic

Lake Vessel Canal & Coast Vessel

Gradual deployment

Shuttle

Marine

Beyond PT

Contribution to 2030 SDT %

Mode

Metro/

other Rail

Bus

SDT

Strategy

Marine Taxi/Shared

Mobility

Beyond

PT

1

(% Total Trips)

Target

2030

25%9.5%

11% 2.6%

~1.8%

~0.1%

SDT Roadmap

22 23

24

800 9090 rta.ae