© Avid.legal Limited 2020

COVID-19 AND RENT AND OUTGOINGS ABATEMENT UNDER SOME NZ LEASES

This document may help you save some rent payments under your lease during these difficult times.

Feel free to share it with others who you think might benefit from having this information too (and

suggest they contact their own lawyer if they need advice/guidance).

Disclaimer: This isn’t intended to be legal advice for your specific circumstances. Rather, it is intended

to help and empower businesses with a general strategy of preserving cash flow in these difficult

times. Each situation will turn upon its own unique facts. Please seek advice if necessary.

Rent abatement?

Some Auckland District Law Society (ADLS) leases include a right to abate rent payments during

circumstances that can include NZ’s COVID-19 Alert level 3 or level 4. Abatement is a right to adjust

the rent (and sometimes outgoings) according to the circumstances (discussed more below) for a

period of time. Whether it applies in NZ’s COVID-19 Alert level 3 or level 4 is dependent on the

contractual clauses in your lease agreement, and how NZ’s COVID-19 Alert level 3 or level 4 impacts

your ability to access and use of the premises.

What lease forms?

A right to abate rent and outgoing payments may apply to you if:

1. you are required to cease conducting your business from your premises during NZ’s COVID-

19 Alert level 3 or level 4; and

2. you have:

(a) an ADLS “Deed of Lease”, sixth edition 2012 with a clause headed no access in

emergency (likely to be clause 27.5).; or

(b) an ADLS “Agreement to Lease” entered into in any time from 2012 or later that states

that the lease shall be documented on the current ADLS Deed of Lease form (clause 4

headed “Lease” for most Agreements to Lease), and

3. the relevant clause hasn’t been excluded or amended in a way that it won’t apply (that’s a

great double-negative, but hopefully you get the point!).

These forms of lease are common for commercial and office space. I suggest you check your lease to

see if this applies to you.

If this applies to you, then you may be relieved of the obligation to pay the full amount of your rent

and outgoings while we remain at COVID-19 Alert level 3 or level 4.

Some other forms of lease may also have a similar right (but not many in our experience). Again, we

suggest you check the specifics of your lease.

Why we think it applies

Paraphrased the no access in emergency provision (clause 27.5) provides that a tenant is entitled to a

fair abatement of rent and outgoings where:

1. if there is an emergency (non-contentious);

2. you are unable to gain access to the premises to fully conduct your business; and

3. that access is restricted because of reasons of safety to the public or the need to prevent,

reduce or overcome any hazard or harm.

Like everything in law, there are always contrary arguments. While we think it pretty clear, expect for

landlords to argue:

© Avid.legal Limited 2020

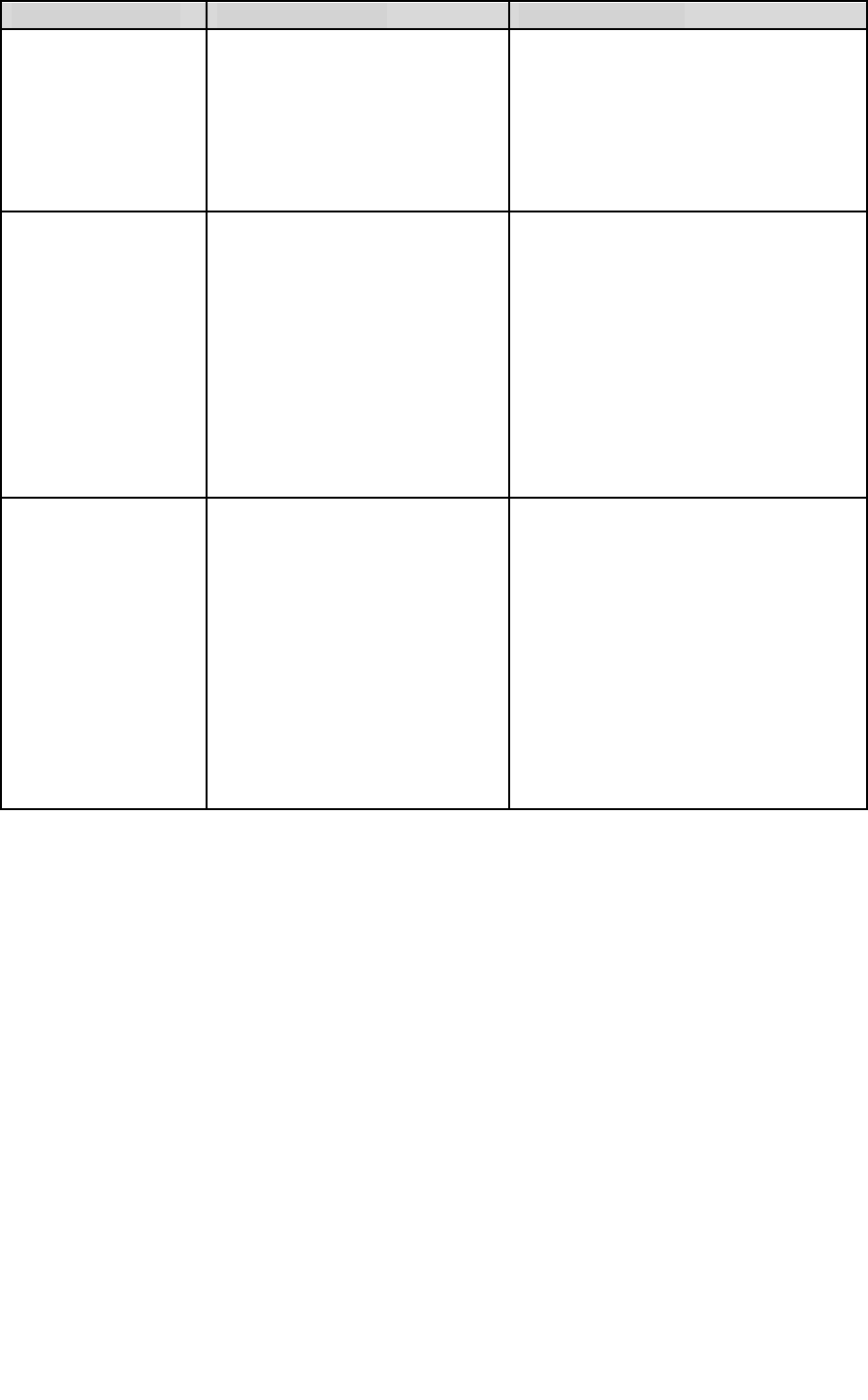

Counter-argument

Landlord rationale

Our observations

Access is still

available

That you are still able to gain

access to your premises but it

the restrictions associated with

COVID-19 are just stopping

people from accessing your

premises.

We don’t favour this argument given

that the Government directions also

include a directive to shut all non-

essential business.

If you operate an essential business

things may well be different.

Obligation to pay

rent is absolute

Even if the clause applies, you

cannot self-abate. The

obligation to pay rent is

absolute. It is not for the tenant

to unilaterally determine the

level of abatement is applied.

Agree the tenant must pay ‘rent’, but

that rent (and outgoings) is adjusted

by an abatement.

I.e., if rent is abated 40%, then the

obligation is to pay that adjusted rent

(i.e., remaining 60%). If rent is abated

100%, then the obligation is to pay

that adjusted rent – it’s just been

adjusted to zero for the duration of the

abatement.

Abatement should

be something less

than 100%

The clause requires a fair

abatement of rent – it doesn’t

specify who it must be fair for

and therefore any abatement

must also assess the interests of

the landlord.

Our starting position is that the

abatement provisions is principally

there for the benefit of the tenant, and

therefore to the extent that the tenant

cannot operate their business from the

premises, then 100% abatement is fair.

However, we do think there is scope

for material arguments on this point

(especially around outgoings to the

extent they can’t be stopped or

reduced).

What to do if you have rights of this nature?

Putting aside the legal side of the lease, there is a community aspect and landlords (and their staff,

and families) are also affected by this too.

We don’t say this on the basis that you should forego your rights, and you need to look after your

business, but be mindful of how you communicate with your landlord and on what arrangements you

seek to obtain. Commercially while the immediate short-term economic pain of COVID-19 is felt, in

the long-term we suggest not burning bridges with your landlord – landlords are long-term partners.

Within the above context, we suggest promptly notifying your landlord (or sub-landlord if you sub-

lease), making them aware of the situation as it applies to your business, and noting your right to

abate (perhaps amongst any other matters you wish to ask for/negotiate).

In relation to any right in a lease to abate, you’ll need to make a judgement on:

1. duration: whether your inability to gain access to the premises to fully conduct business

applies to your type of “non-essential business” during just Alert level 4, or both Alert level 3

and level 4; and

2. fair portion: what a fair portion of rent and outgoings to abate should be.

© Avid.legal Limited 2020

For many tenants with a 100% restriction on operating their business from the premises, a fair portion

to abate may well be 100% of your rent and outgoings – but this is not certain and will depend on

your individual circumstances and may be argued to the contrary by landlord (see the table above).

Ultimately this will be down to an objective test. If you have applied too high of a percentage – you

will be liable for the shortfall, which could put you in breach of your lease. If in doubt, seek advice.

The draft landlord notification below assumes a 100% abatement of rent and outgoings for the

duration of level 3 and level 4 – and doesn’t extend to any other matter or terms you might wish to

negotiate. Note: while a 100% abatement of rent may be fair, a 100% abatement of outgoings may

not be fair. This will depend on your own particular circumstances.

Instead of abatement now, you may want to try and open up a wider discussion to negotiate a better

deal with your landlord. We’ve seen instances of different arrangements, e.g., longer rent holidays or

reduced rent spread over a longer period of time. Government announcements about mortgage

holidays and some moves in respect to bank business loan relief may help your landlord help you too.

Be conscious it may take some time for your landlord to be able to respond – but hopefully many are

in a position to respond.

Please adjust the notification for your situation, including the items in square brackets.

Suggested notification to landlord if you have a rent abatement right

Dear [insert valued landlord name/contact],

Subject: Covid-19 rent and outgoings abatement – [insert name of business, and premises

address]

I hope this notice finds you and close ones safe in these difficult times.

As a result of the Government’s declaration that NZ moved to COVID-19 Emergency Alert

[“level 3 on 23 March and] “level 4” on 25 March, our business cannot access the premises at

[insert address] to fully conduct our business and clause [27.5] of the Deed of Lease (no access

in emergency) applies.

This clause provides for a fair proportion of the rent and outgoings to be abated where there

is an emergency. Emergency is defined in clause 45.1(d) of the Deed of Lease and includes an

“epidemic”.

As you can appreciate, we are unable to gain access to the premises to fully conduct our

business from the premises because of:

reasons of safety of the public or property; and

the need to prevent, reduce or overcome any hazard, harm or loss that may be

associated with the emergency.

Given we have a 100% restriction from operating our business from the premises under

COVID-19 Emergency Alert [level 3 from 23 March and] level 4 from 25 March, we consider an

[100%] abatement of our rent and outgoing payments for the duration of time that the NZ

has declared a COVID-19 Emergency Alert level 3 and level 4 as fair.

© Avid.legal Limited 2020

The Government expects this level of alert to last for at least 28 days at this point (i.e., until at

least 19 April) but it may be longer. We will start to apply a 28 day abatement in our next rent

payment.

We are mindful this may hurt your financial position, and we value our relationship with you.

Our business is also hurting as a result of these Covid-19 restrictions. The impact on our

business has been immediate and significant. Unfortunately, we need to exercise this lease

right at this time to manage our controllable cost structure with the same immediacy and

don’t do it lightly. We hope that the crisis will be abridged, and we can resume normal rent

practices just as quickly.

Please acknowledge receipt of this notice.

Please don’t hesitate to contact [insert name and contact details] if you would like to discuss.

We look forward to working together during this difficult time

[sign off]

_______________________________________________

Any questions, get in touch:

www.avid.legal